Budget 2025, New Income Tax Slabs: in a Major Relief to the Middle Class, Finance Minister Nirmala Sitharaman Today Announced that No Income Tax will be paid will be paid The move will significantly Benefit Salarized Taxpayers as this Limit will be Rs 12.75 Lakh Rupees for Them (With Rs 75,000 being standard deduction).

Sitharaman said “to tax payers up to Rs 12 lakh of normal income (other than special rate income is no tax payable By them. “

As per the rejig, for people earing more than Rs 12 lakh per annum, there will be nil tax for income up to Rs 4 lakh, 5 per cent for income better , 15 per cent for Rs 12-16 lakh.

Budget 2025: Revised Tax Slabs for fy 2025-26

| Revised Tax Slabs (fy 2025-26) | |

| 0-4 Lakh Rupees | Nil |

| 4-8 Lakh Rupees | 5 per cent |

| 8-12 Lakh Rupees | 10 per cent |

| 12-16 Lakh Rupees | 15 per cent |

| 16-20 Lakh Rupees | 20 per cent |

| 20- 24 Lakh Rupees | 25 per cent |

| Above 24 Lakh Rupees | 30 per cent |

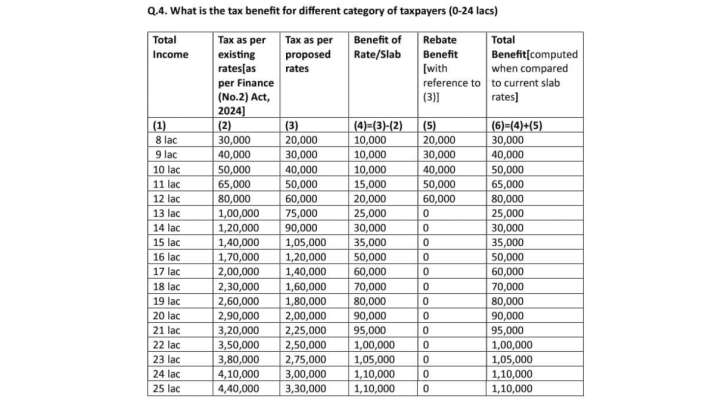

Here’s how the total tax benefit of slab rate changes and rebates will work

- A Taxpayer in the new regime with an income of ₹ 12 lakh will get a benefit of Rs 80,000 in tax (100 per cent of tax payable as per existing rates will be exhempt). The effective income tax rate will be 0 per cent.

- A person having an income of ₹ 16 lakh will get a benefit of Rs 50,000 in tax. (The effective income tax rate payable will be just 7.5 per cent).

- A person having an income of Rs 18 lakh will get a benefit of Rs 70,000 in tax. (The effective income tax rate payable will be just 8.8 per cent).

- A person having an income of Rs 20 lakh will get a benefit of Rs 90,000 in tax. (The effective income tax rate payable will be just 10 per cent).

- A person with an income of Rs 25 lakhs a benefits of Rs 1,10,000. (The effective tax rate will be just 13.2 per cent).

- A person with an income of Rs 50 lakh also gets a benefit of Rs 1,10,000. (The effective tax rate will be just 21.6 per cent).

| Inome | Tax on Slabs and Rates | Benefit of | Rebate benefit (For there earning below Rs.12 lakh) |

Total Benefit | Tax after Benefit | |

| Present | Proposed | Rate/Slab | Full rebate upto Rs. 12 lakhs | |||

| Up to 8 lakh | 30,000 | 20,000 | 10,000 | 20,000 | 30,000 | 0 |

| 9 Lakh | 40,000 | 30,000 | 10,000 | 30,000 | 40,000 | 0 |

| 10 lakh | 50,000 | 40,000 | 10,000 | 40,000 | 50,000 | 0 |

| 11 lakh | 65,000 | 50,000 | 15,000 | 50,000 | 65,000 | 0 |

| 12 Lakh | 80,000 | 60,000 | 20,000 | 60,000 | 80,000 | 0 |

| 16 Lakh | 1,70,000 | 1,20,000 | 50,000 | 0 | 50,000 | 1,20,000 |

| 20 Lakh | 2,90,000 | 2,00,000 | 90,000 | 0 | 90,000 | 2,00,000 |

| 24 Lakh | 4,10,000 | 3,00,000 | 1,10,000 | 0 | 1,10,000 | 3,00,000 |

| 50 lakh | 11,90,000 | 10,80,000 | 1,10,000 | 0 | 1,10,000 | 10,80,000 |

Budget 2025: New and Old Tax Regime Before Today’s Announcement

The new tax regime exempts income up to Rs 3 lakh. Thos Earning Annually Between RS 3-7 Lakh Pay 5 Per Kent Tax, Rs 7-10 Lakh (10 per cent), Rs 10-12 lakh (15 per cent), Rs 12-15 lakh (20 per cent) and Above Rs 15 lakh (30 per cent).

The old tax regime, however, exempts income up to Rs 2.5 lakh from taxes. Income from Rs 2.5-5 Lakh Attracts 5 per cent tax, and 20 per cent for Income Between Rs 5 Lakh and Rs 10 Lakh. A 30 per cent tax is levied on Income Above Rs 10 Lakh.