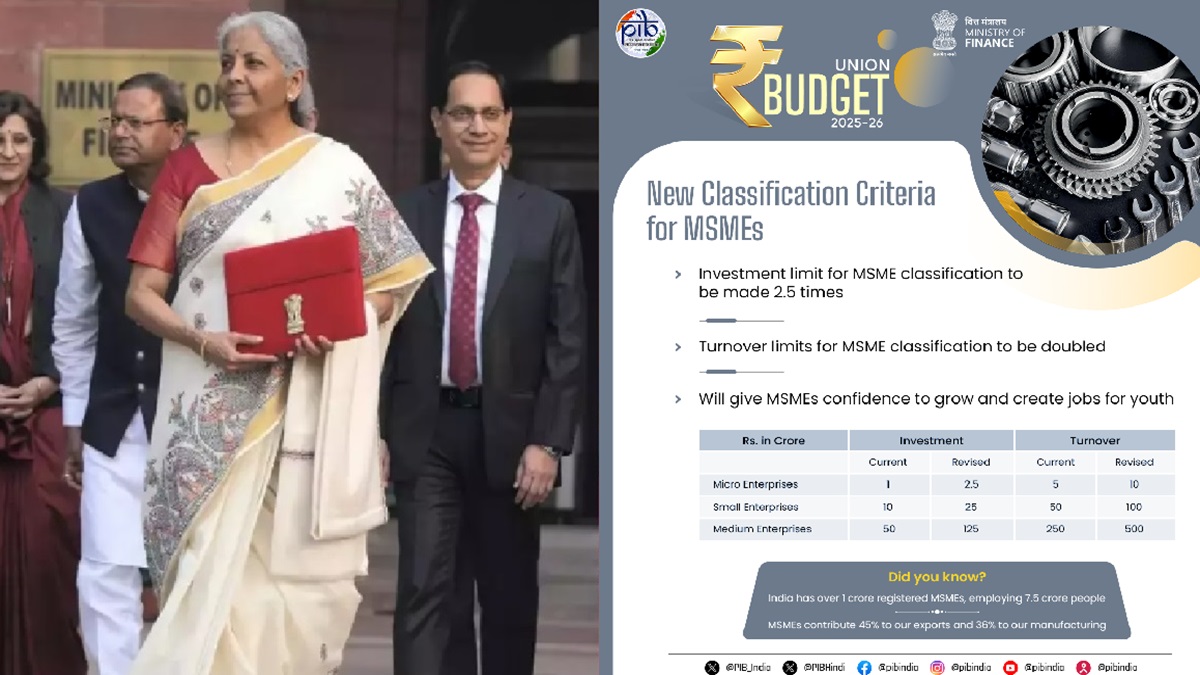

Union Finance Minister Nirmala Sitharaman presented the first full budget of modi government 3.0. Sitharaman Unveiled Her Record Eighth Consective Budget in the Lok Sabha and Announced Key Economic Reforms. One of the Major Sector Emphahsized in this Budget is MSME. Sitharaman Announced A Credit Boost for MSMES or Micro, Small and Medium Enterprises, to Generate Employment, Especially for the Young People. In her budget speech, Finance Minister said the msmes are responsible for 45 per cent of India’s expenses.

“MSME, as a second engine, encompasses manufacturing and services with a focus on msme number 5.7 crore Anufacturing Have Come TogaTher to Position India as a Global Manufacturing Hub, “MS Sitharaman said while presenting her eighth culture union budget.

Enhanced credit cover for msme

To improve access to credit, the credit guarantee cover will be enhanced as under:

- For Micro and Small Enterprises, from Rs 5 Crore to 10 Crore, Leading to Additional Credit of 1.5 Lakh Crore in the next 5 years;

- For Startups, from 10 Crore to 20 Crore, With the Guarantee Feeing Moderated to 1 per cent for Loans in 27 Focus Sector Important for Atmanirbhar Bharat

- For Well-Run Exporter MSMES, For Term Loans Up to 20 Crore

Credit cards for Micro Enterprises

The government has announced to introduce customized credit cards with a rs5 Lakh Limit for Micro-EenterPrises registered on Udyam Portal. In the first year, 10 lakh such cards will be issued.

Budget 2025

As one of the Major Reforms Announced Via Budget 2025, No Income Tax is Payable Up to Rs 12 Lakh. Slabs and rates are being changed across the board. The new structure is introduced to substantial Reduce Taxes of Middle Class and Leave more money in their hands, boosting househld consumption, saving and investment. Finance minister announced ‘nil tax’ Slab up to Rs 12 lakh (Rs 12.75 lakh for salaryed tax payers with standard deduction of Rs 75,000).

In the budget 2025, the Finance Minister also also announced to introduce new income-tax bill. She said that the new bill will be clear and direct in text with close to half of the present law. The new tax bill will be simple to undersrstand, leading to tax certain and reduced litigation. It will be half of the current volume; Clear and direct in wording.